The home cover that is 'shamefully lagging behind'

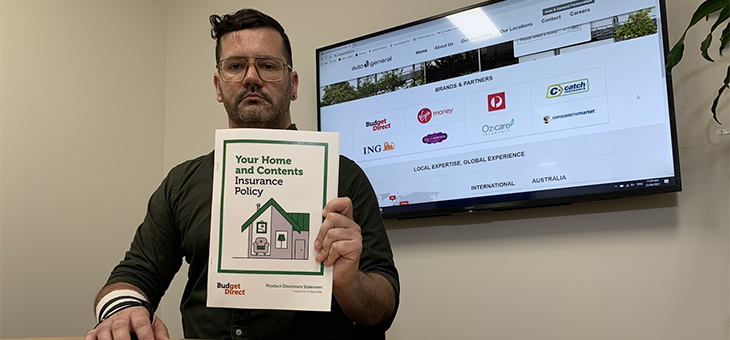

Consumer group CHOICE has slammed the insurer behind Budget Direct, Virgin Money and ING for failing to fix fire definitions in their home and contents policies.

Over a year since the devastating Australian 2019/2020 bushfires, a new analysis by CHOICE has found most major insurers have updated their home and contents policies to address fire definitions previously dubbed by the consumer group as "confusing, unfair or unclear", leaving Auto and General Insurance as the last major insurer to act.

"Auto and General Insurance is shamefully lagging behind on fair fire definitions for Australians," says CHOICE insurance campaigner Dean Price.

"This means when you buy insurance from brands like Budget Direct, Virgin Money or ING there is more wriggle room for Auto and General Insurance to get out of paying or rebuilding if the worst happens to your home. Their definitions mean that damage caused by melting, smouldering or smoke doesn't have to be covered by their policies," Mr Price said.

"Insurers must stop hiding behind tricky and confusing definitions of fire. Every Australian should have peace of mind that they'll be covered if their home is damaged by a fire. We should be able to trust that we're covered. Our homes should be covered regardless of whether the fire damage is from flames, heat, or smoke."

CHOICE’s 2020 investigation found 70 per cent of the policies analysed contained dodgy fire definitions, with a repeat analysis in April 2021 finding only Auto and General Insurance and Youi insurance still lagging.

Since contacting the lagging insurers, Youi has committed to changing their definitions with no response from Auto and General Insurance.

"It's simply unacceptable to leave your customers with such confusing policies. Australians need to be confident that their insurer will have their back when the worst happens. Leaving these dodgy definitions in place at this point just shows contempt for your customers," Mr Price said.

CHOICE is calling for Australians to demand better from Auto and General Insurance and their brands. Australians can join the petition for these brands to fix their policies here: www.choice.com.au/fireinsurance.

Who do you use for home insurance? Have you ever had to make a claim? Were you satisfied with the way your claim was handled?

"Our homes should be covered regardless of whether the fire damage is from flames, heat, or smoke."

What about the damage caused by the fire service doing their job? Such as damaged doors to gain access, water inundation or foam from the fire in the next unit etc? Are these covered if you are affected by fire but not the seat of the fire?