Housing collapse and Government complicity

PERTH WA, The Capital city of the largest state in Australia,

Suburb: ARMADALE 33.4 kilometres from PERTH City. (SNAPSHOT JANUARY 2019)

Did you know?

-

FIFTY Homes are UNDER $200,000

-

SEVENTEEN Homes are under $175,000

-

EIGHT Homes are under $150,000

SOURCE: (4) “SNAPSHOT” DATE 23rd January 2019

I CONTEND: “The Liberals” have “thrown the baby out with the bathwater”

Few would argue that the “Sydney” Housing Market needed an adjustment, however, the one size fits all, is indicative of sustained “POOR POLICY” by the current Government. The “fix” has had some success “Temporarily cooling” the Sydney market, but, in doing so utterly destroyed the lives of “perhaps” millions of Australians, all over our land.

-

I am one of them. I own (sic) three properties, two in Camillo and one in Kelmscott. TWO of the THREE are worth “less” than in 2006.

-

I am a victim of the Australian Prudential Regulation Authority’ (APRA) cap on interest only loans. As instigated by the Turnbull/Morrison Government.

-

I am old, it was my hope, some 15 years ago to be able to reduce my burden to the Australian People, by providing (Largely) for my own retirement.

-

My wife and I face a bleak future, we will lose all three homes – no power exists to stop that.

-

INSTANT restoration of “interest only”, on all my properties is the ONLY solution. A solution that will allow for a “dignified” sale of all three properties over time. AND A fairly certain funding arrangement, WELL within my means.

-

IMPORTANTLY it will facilitate a dignified exit for my tenants.

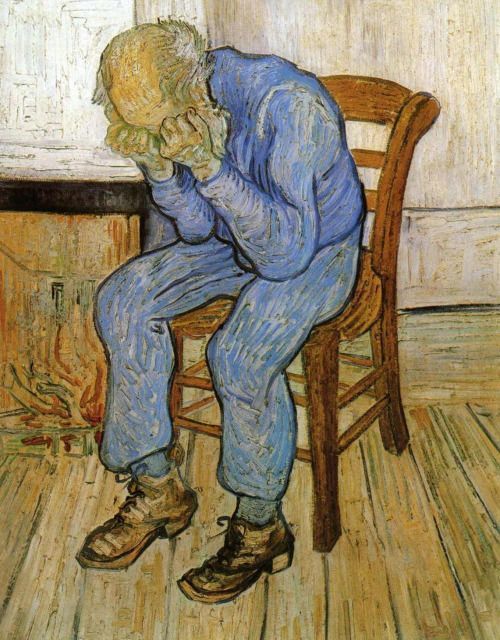

Up until the end of last year, I seriously considered, ending my life, which is my choice. However, as much as I still feel this will end this nightmare, it will hurt the ones I love far too much for me to bear – the sense of hopelessness is overwhelming. I have worked my entire life, NEVER touched base with centrelink – until I applied for the OAP.

Some of you “may” say I “youshould have known just as I did”! Sadly for people like me, we don’t have the wherewithal that you have – people like me, allows people like you, the pleasure of gloating.

To use a well worn “idiom” “But there’s more”, well there certainly is. Two of my properties are rented. One by a Single Woman in her late fifties – she has lived there for almost 13 years. Her son is in Prison, she of course is devastated and NOT to blame in any way. I support her fully, as best I can. Her rent has not changed since 2009. She keeps “Her Home” so beautiful, BEST garden in her street.

The second property by a (Now) Married Couple. It was initially let to X, before her marriage to XX.

X has rather severe intellectual dysfunction, however, she IS intelligent and aware of her disorder. They want to remain, having been there for 9 years or so.

Without challenging “War & Peace’s” rather large “word count” Both these people will suffer severe disruption to their lives, when the banks order them out. There is always collateral damage – but, the mark of a compassionate society is how we dish out the compassion. There will be NO compassion from the banks – they will destroy me AND they will destroy them.

MY/OUR WORLD.

The area in which we both call home (ARMADALE WA) has been devastated (Deliberately) by both the Liberals and their underlings; the banks - (Or is that vice versa??).

A Noted “Banker” $AUD Billionaire, Malcolm Turnbull was architect, as was his underling, the (Then treasurer) “multi millionaire” Scott Morrison.

We have 10 BILLIONAIRE politicians and countless “millionaires” from BOTH sides of parliament (5)

Whilst the Liberals have used APRA; it is not without criticism. Recently, the Reserve Bank Assistant Governor, Christopher Kent blamed "unnecessary" credit tightening in December 2018 for further threatening the market. (1) AND yet credit is tightening further in 2019

The Australian Prudential Regulation Authority announced it was removing a cap on interest-only loans for residential property, on the grounds that the measure had reached its objective of curbing higher-risk lending practices. (3)

APRA said the cap had "led to a marked reduction in the proportion of new interest-only lending, which is now significantly below the 30 per cent threshold". Minister responsible: Scott Morrison MP, Treasurer of Australia (Since 2015).

ADDED COMMENT from a member of “yourlifechoices.com.au”

It was a deliberate targeting of a sector of the investing public - who were doing the right thing, providing shelter for others and providing for their own and their family's future at the same time.

APRA, the government and the Opposition knew full well that while these small 'mums and dads' investors were large in number, they would have difficulty organising themselves to protest, they had little political clout (GetUp wouldn't be representing them for starters) and both sides of politics were using them as a scapegoat. (7)

I would like to add to this members contribution:

Few would know the “hidden” role “some”, 'mums and dads' investors, play in their relationships with their tenants. I know of many and I include ourselves. I am torn between offering my example and remaining silent, for fear I may inadvertently identify my tenants. Hence I will stay quiet and err on the side of caution.

I suggest the fallout will be significant, sustained and painful for a great many people, particularly those with the least skills to navigate their way out.

SOURCES:

-

https://thewest.com.au/business/housing-market/another-12-months-of-pain-before-perth-property-bounce-says-moodys-and-corelogic-ng-b881066879z

-

http://thebankdoctor.org/resources/glossary/

-

https://www.afr.com/business/banking-and-finance/apra-removes-interestonly-lending-cap-says-its-served-its-purpose-20181219-h199rk

-

https://www.realestate.com.au/buy/property-house-between-0-200000-in-armadale,+wa+6112%3B/list-1?activeSort=price-asc

-

https://toprichests.com/top-10-richest-politicians-of-australia/

-

http://www.lawfoundation.net.au/ljf/app/&id=/2FD34F71BE2A0155CA25714C001739DA

-

https://www.getup.org.au/

I thought those interest only loans were only for a max of 5 years?